How To Gift Money To Family Members Tax Free

By Staff Writer Last Updated April 11 2020 A person can gift money to a family member without paying tax by not exceeding the basic exclusion amount notes the official web site of the Internal Revenue Service. Realistically however for many lending may be the only option.

Gift Money Can Meet Your Down Payment Needs Nerdwallet

Generally you dont need to report money received as a gift in your tax return if.

How to gift money to family members tax free. However if the money earns any interest in an Australian bank account thats considered assessable income and youll need to report that interest in your tax return. This is an excellent. Distasteful as it may seem within a family putting everything down in writing is not just sensible its vital.

This could apply to parents giving money to. In 2020 the annual gift exclusion gives you a per-person tax-free gift limit of 15000. The gift isnt connected to any income-producing activities by you.

Hi Ray and Sabina. Any amounts paid toward an individuals medical or education expenses are not subject to the gift tax limits. If youre their grandparent you can give up to 2500 tax-free.

As Jamie Golombek Managing Director Tax and Estate Planning at CIBC explains if you purchased a home for 350000 but you gift it after its reached a market value of 550000 you will be accountable for reporting the 200000. Whatever you decide make sure the terms of the gift or loan are clear. There are several scenarios in which you can give money to family members tax-free.

The gift tax is imposed by the IRS if you transfer money or property to another person without receiving at least equal value in return. And even then you likely will not owe taxes. There are a few other ways to gift to family members without dipping into your lifetime gift and estate tax exemption.

For 2021 the annual gift tax exemption will stay at 15000 per recipient. The Saga survey found that 27 of those who had lent money to grandchildren. The basic exclusion amount is a lifetime limit that is used in gift tax.

For you to be able to enjoy this exception you must pay directly to the provider of those services ie make a check. The good news is you can gift cash to your children with no tax consequences to yourself or the children. However any gift of property such as a home which is not considered your principal residence given after the value has gone up is subject to Canadas 50 capital gains tax.

This annual exclusion applies to each taxpayer so if youre married you and your spouse. For anyone else you can give up to 1000 tax-free. Giving money is invariably better.

This means you can give up to 15000 to as many people as you want during the coming year without any of it being subject to a gift tax. You dont even have to report this gift or gifts on your income tax return. Your taxable imputed interest income is zero.

The money is a gift from a family member for personal reasons. Oct 22 2015 - If you have a desire to gift a sum of money to members of your family you will likely be able to do so without too much oversight by the IRS. What this means is that you can give up to 15000 to an unlimited number of people during the tax year without having to pay a gift tax.

Other ways to gift to family members. It is less complicated and may have tax advantages. Cash birthday presents or similar amounts that you receive from your family members are not included in your taxable income.

You make a 100000 interest-free loan to your beloved niece who has 200 of net investment income for the year. As of tax year 2018 you may gift individuals up to 15000 annually before needing to report this. If youre their parent you can give them up to 5000 tax-free.

Amounts may be taxable if you receive them as part of a business-like activity or in relation to your income-earning activities as an employee or contractor. First any money you give to your spouse or civil partner is tax-free.

What Is The Lifetime Gift Tax Exemption In 2020 Smartasset

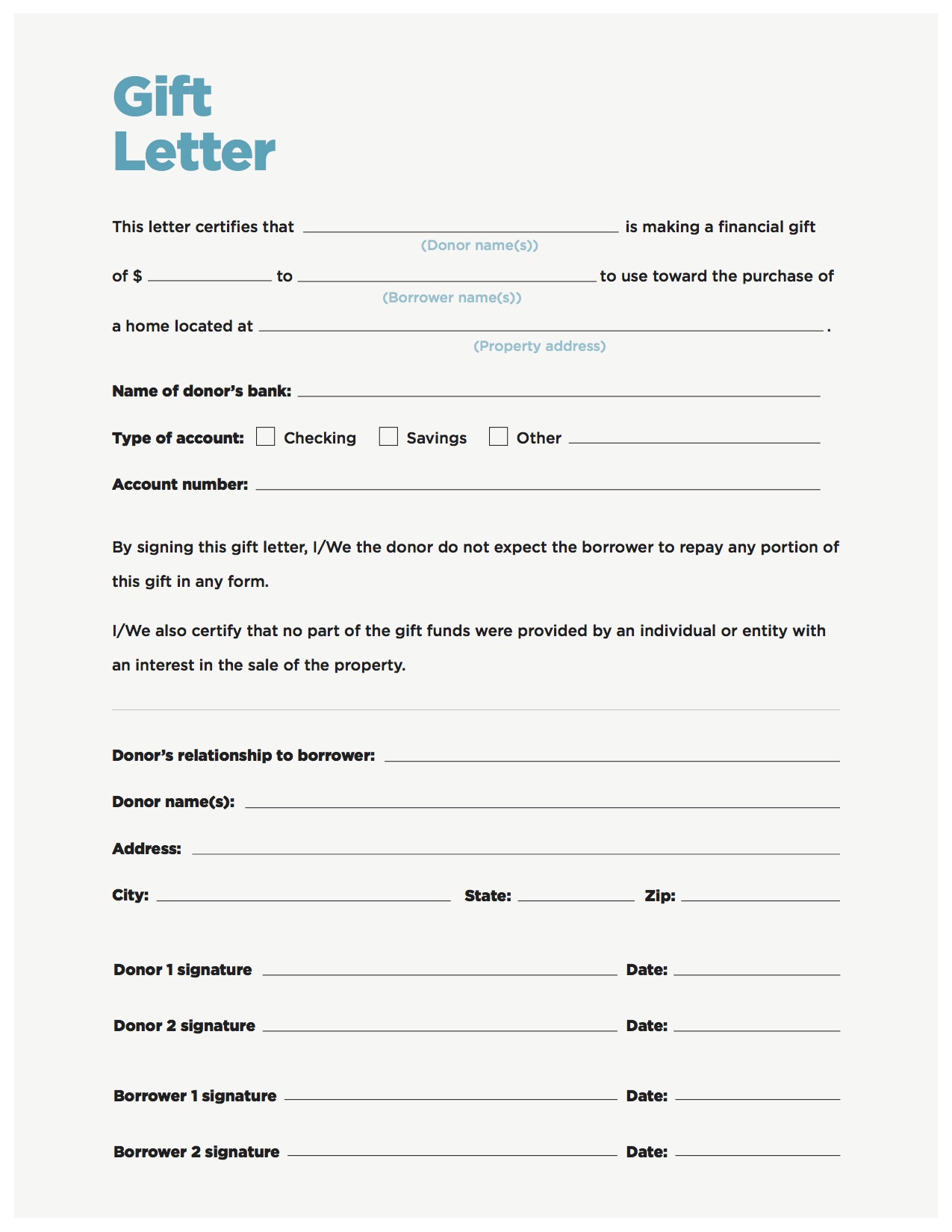

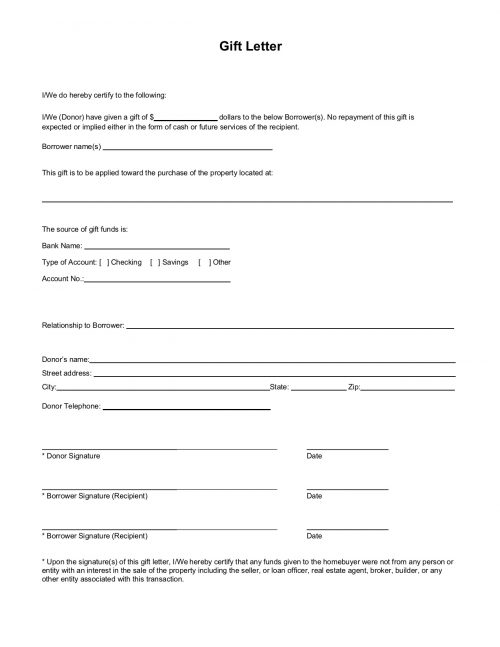

About Cash Down Payment Gifts For Home Buyers

How Much Of A Gift Can You Give To Someone To Buy A House

A Card Is Like A Gift Tax Because Most Of The Time Unless Its Homemade Which I Always Appreciate Its Going In The Garbage Anyway A Money Gift Gifts Cards

F709 Generic3 Lettering Worksheet Template Profit And Loss Statement

Gift Tax Do I Have To Pay Gift Tax When Someone Gives Me Money

Us Military Get Your Taxes Done Free With H R Block Recipes For Riches Tax Preparation Military Getting Things Done

Understanding Clubbing Of Income Blunders People Make Infographic Income Financial Health Financial Management

Do You Pay Taxes On Gifts From Parents Smartasset

Do I Have To Pay Taxes On A Gift H R Block

How To Put Your Tax Refund To Good Use Making It Pay To Stay Tax Refund Money Saving Advice Money Management Advice

Gift Tax 3 Easy Ways To Avoid Paying A Gift Tax Taxact Blog

What Is The Gift Tax Irs Rules Rate Maximum Exclusion Limit Family Money Personal Finance Bloggers Personal Finance Advice

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Mortgage Down Payment Gift Rules What You Should Know

Take A Stroll Down The Tool Aisle For Holiday Gift Ideas In 2021 Holiday Gifts Boyfriend Gifts Gifts

Tips For Giving Away Money To Family Members Estate Planning Best Way To Invest Retirement

/money-for-you-172411636-fbc9ab4f707a49c08e17bc07f45f3f1d.jpg)

Post a Comment for "How To Gift Money To Family Members Tax Free"