Does Taxes Get Taken Out Of Unemployment

The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take taxes out. All government unemployment benefits are counted as income according to the IRS.

The Small Business Checklist Business Checklist Business Infographic Small Business Start Up

You can choose to have income tax withheld from your unemployment benefits if necessary to avoid an unpleasant surprise next year when you file your return.

Does taxes get taken out of unemployment. You could get a hefty tax refund this year. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid Relief and Economic Security CARES Act enacted this spring. Unemployment benefits are usually taxable as income and are still subject to federal income taxes above the exclusion or if you earned more than 150000 in 2020.

Most states do not withhold taxes from unemployment benefits voluntarily but you can request they withhold taxes. Youll still pay significantly less in FICA taxes than you would have had you been working if you collected unemployment through a significant part of the year. On the other hand if youve been having income tax withheld from your pay for a substantial portion of the year already you may be way.

When it comes to federal income taxes the general answer is yes. Unemployment compensation is not subject to FICA taxes the flat-percentage Social Security and Medicare taxes that would normally be withheld from your paycheck if you were working. By law unemployment compensation is taxable and must be reported on a 2020 federal income tax return.

The IRS announcedit will send another round of refunds to nearly 4 million people who paid taxes on unemployment compensation they received last year. Visit your states unemployment website and elect to have taxes taken out if youre still collecting UI. The first refunds are expected to be made in May and will continue into the summer.

Before you do however make sure thats necessary. By signing the plan into law on March 11 Congress removed the federal taxability of 2020 unemployment benefitsup to 10200 for individuals and 20400 for married couples filing jointlyfor. Unemployment benefits are taxed just like income said.

If you are receiving unemployment benefits check with your state about voluntary withholding to help cover your income taxes when you file your tax return. Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020. Normally all unemployment income is taxable at the federal level but the new relief bill exempts jobless workers first 10200 in benefits for those earning less than 150000.

The legislation excludes only 2020 unemployment benefits from taxes. If the IRS determines you are owed a refund on the unemployment tax break it will automatically correct your return and send a refund without. Federal income tax is withheld from unemployment benefits at a flat rate of 10.

You can use Form W-4V Voluntary Withholding Request to have taxes withheld from your benefits. Additionally any supplemental benefits coming from company-funded programs are not taxed as income but as wages. However theres a difference that could cause Americans to pay less tax relative to levies on a typical paycheck.

Because the change occurred after some people filed their taxes the IRS will take steps in the spring and summer to make the appropriate change to their return which may result in a refund. Taxes on Unemployment Many people incorrectly assume that they wont have to pay any income tax if theyre unemployed. Even though taxes arent taken out of your unemployment check youre still expected to pay taxes on the benefits you collect which is taxed as regular income.

Unemployment benefits are generally taxable. If your only income for the year is your unemployment the only tax form youll receive is Form 1099-G. That said both Baer and Hawvers advice to those who continue to collect is crystal clear.

4 Depending on the number of dependents you have this might be more or less than what an employer would have withheld from your pay. The answer is yes.

Handy Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Small Business Tax

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

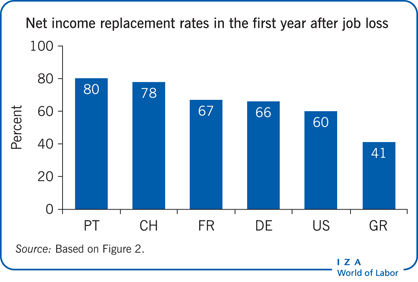

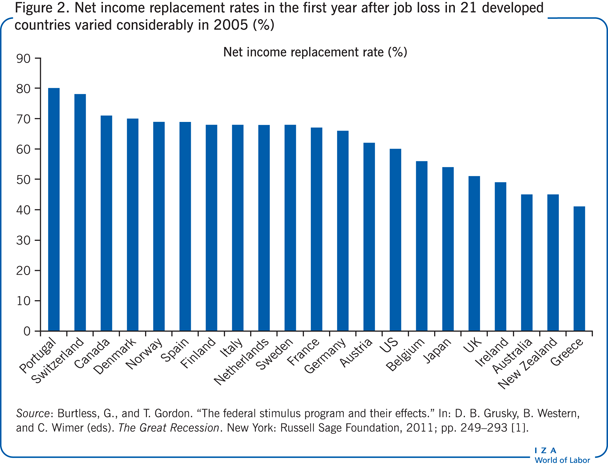

Strengthening Automatic Stabilisers Could Help Combat The Next Downturn Vox Cepr Policy Portal

Your Bullsh T Free Guide To Taxes In Germany

Unemployment Tax Refund Taxpayers Frustrated By Irs Unresponsiveness

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Irs To Start Sending 10 200 Unemployment Benefit Tax Refunds In May

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Deductions Might Help Reduce Your Tax Liability Tax Time Filing Taxes Paying Taxes

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com

Your Bullsh T Free Guide To Taxes In Germany

Is Unemployment Taxable During A Pandemic Credit Karma Tax

Iza World Of Labor Unemployment Benefits And Unemployment

Tax Refunds On 10 200 Of Unemployment Benefits Start In May Irs

Your Bullsh T Free Guide To Taxes In Germany

Unemployment Benefits In Germany Arbeitslosengeld

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Iza World Of Labor Unemployment Benefits And Unemployment

Unemployment Benefits Tax Free Do You Need To Amend Your 2020 Tax Return Youtube

Post a Comment for "Does Taxes Get Taken Out Of Unemployment"